The 3 Most Common Challenges with On Demand Pay and How to Fix Them

If there’s one thing that can be universally agreed on in today’s rapidly changing business world, it’s that companies of any size have complex payroll needs that require fully integrated payroll solutions to keep them attracting and retaining top of the line talent.

One of the latest trends in that sphere is the concept of on-demand pay, also known as earned wage access (EWA). Common challenges with on demand pay can cause payroll departments to flounder and lead to lots of mistakes if organizations do not have a modern cloud HCM and financials system in place to handle them.

On Demand Pay 101

This new wrinkle into the traditional payroll system allows employees to access some or all their funds as they are earned, meaning they can pull them before the standard two-week interval when paychecks are issued. It isn’t free, however; there are typically fees that re-accrue on a per-use basis by the employee.

Obviously, offering this type of service can cause issues in standard payroll processing software. Schedules and step-by-step systems have been the way that payroll departments have worked for decades.

But those same companies also understand that if they want to compete for a quality workforce in this tight labor market, they must prove that they are concerned about their employees’ financial well-being. The 2022 PwC Employee Financial Wellness Survey showed that 76% of employees would consider heading for greener pastures based on their perception of whether their employer or another company cared about their financial well-being.

But what problems arise with on demand pay capabilities and how can you solve them?

1. Compliance and Tax Reconciliation Problems

First, making sure HR and payroll compliance are in effect for any and all taxes is solely the responsibility of the employer. Employees who take out money early in the payroll cycle might not be taxed on it until they receive their actual paycheck, which will then appear lower than normal as a result.

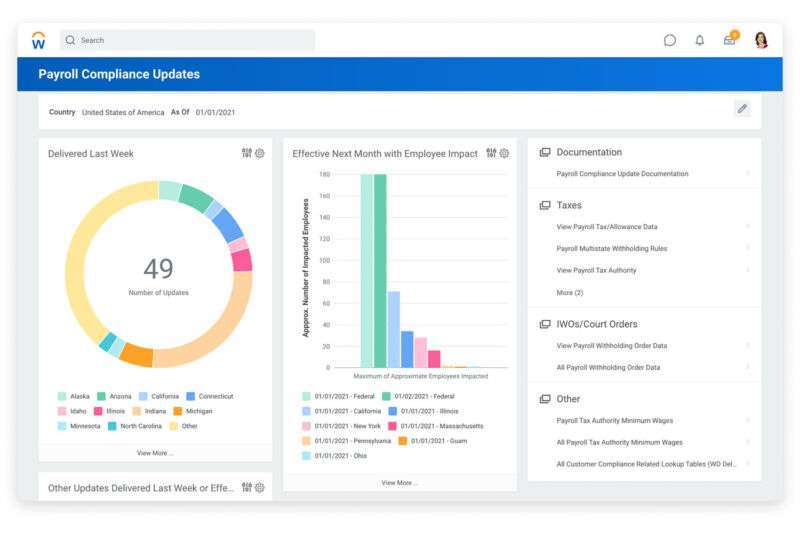

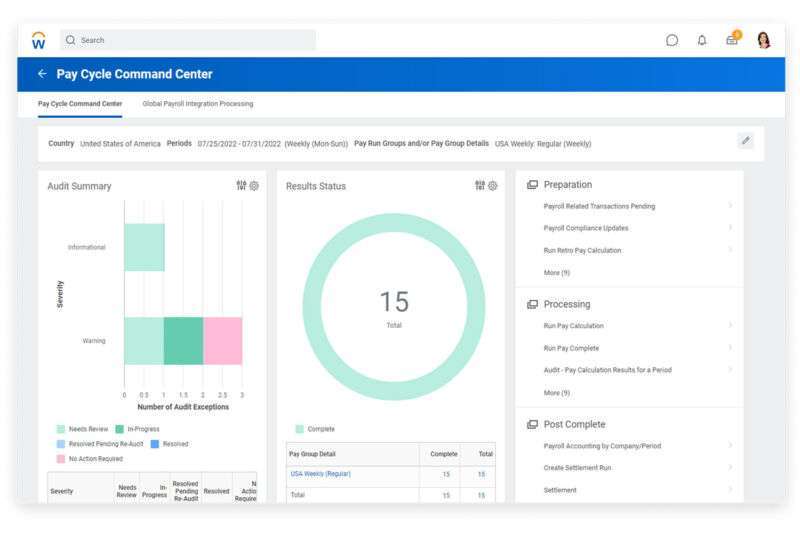

Using a system like Workday Payroll Management can keep that from happening thanks to its ability to be configured to meet specific needs. More importantly, it can be configured on a case-by-case basis without worry that the entire payroll run will be affected by changes in a few employees’ method of payment.

2. Issues Setting up Payments

Let’s face it, payroll professionals of yesteryear were the most criminally unappreciated employees of all time, going through timecards and terrible handwriting and all the rest to put out checks every couple of weeks.

We don’t want to make today’s incarnation go back to that system by having to manually input all sorts of requests and exceptions to the rule. Fortunately, Workday Payroll Management has advanced payroll capabilities that allow users to make changes, automate processes, and let the system do the heavy lifting.

3. Trouble Staying in the Black

Part of the reason that companies haven’t always allowed this pay-as-you-go functionality is because they have to make the money themselves before they can pass it on to their employees. Nothing can be more damaging and embarrassing than a company offering on-demand pay that doesn’t actually have the money to make it happen.

Workday Payroll Management offers a payroll reconciliation functionality that ensures the company’s financial health is of paramount importance and gives a detailed, easy-to-read picture of how the company is doing financially in a near real-time environment.

Next Steps

Considering how to streamline or optimize your payroll functionality and unsure where to start? ERPA’s experienced Workday Payroll Management experts can consult with you about the best solutions for your organization and how to implement them. Contact us today for a closer look at solving these common challenges from on demand pay.