Workday Payroll Management Solves Common Payroll Issues

Workday Payroll is designed specifically to aid your organization’s complex payroll needs with the flexibility to constantly evolve and improve on performance. If yours is a company that has lots of different types of employees on many different salary schedules, Workday Payroll Management can be a solution that you’ll look back on and wonder how you ever survived without it.

Pay Groups and Audits Simplified with Workday Payroll Management

Anyone who has ever needed a solution with advanced payroll capabilities is the perfect target audience for Workday Payroll Management as it has top-flight solutions for these common payroll issues:

Different Pay Groups

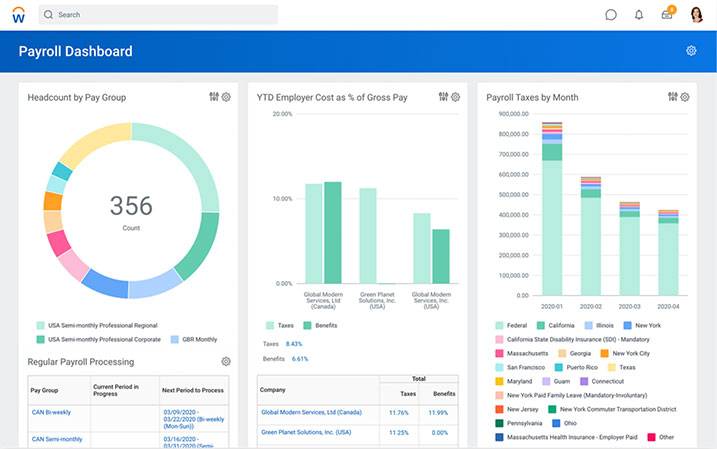

As the world’s workforce gets more diverse and more spread out, many organizations are no longer cutting everyone’s check every other Friday and dropping them in mail slots. Different batches of employees are working remotely, part-time, on salary, hourly, on contracts, and in different states and even different countries with different payroll parameters.

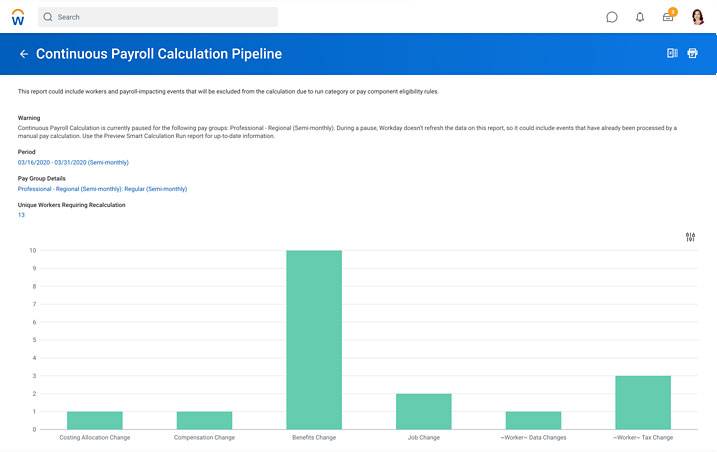

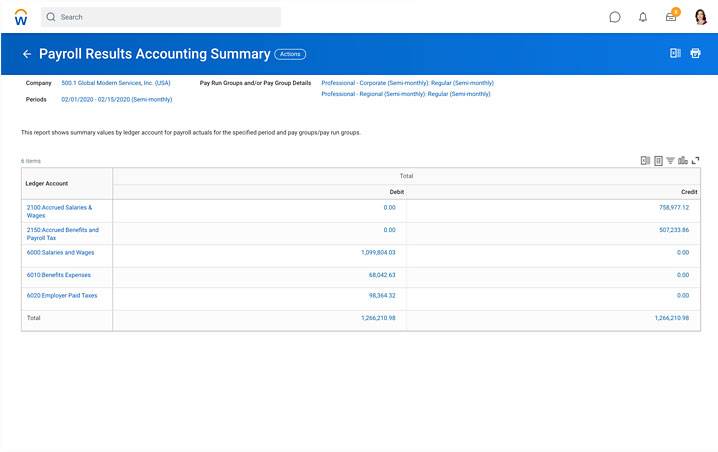

Pay groups – workers defined by having their pay processed and calculated the same – usually must be run one at a time on legacy software, but not so with Workday Payroll Management. It can run multiple pay groups at the same time and do some on an automated system so that your payroll specialists can focus on more high-level work and strategic decisions.

Automatic Tax Updates

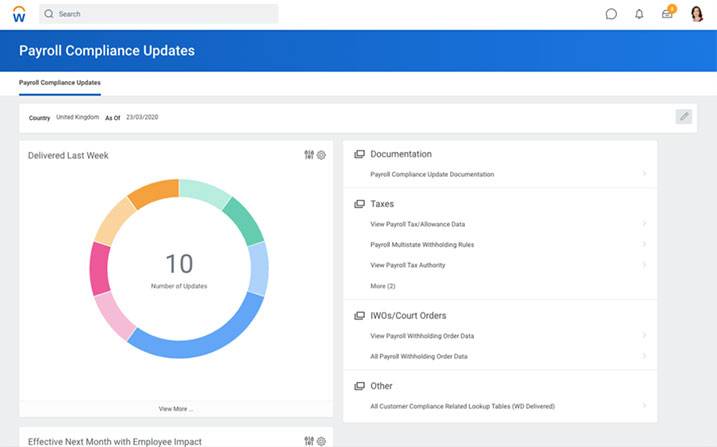

We get it, nobody likes paying taxes, reading about taxes, or even thinking about taxes, but taxes are inevitable, as the old saying goes. Making sure you’re taking the proper amount of taxes out of your employees’ checks each pay period isn’t just vital for your own year-end filings, but your employees’ as well.

Nobody wants to be the HR rep on duty when a legion of employees descends on the help desk after finding out they either paid way too much to the government or even worse, way too little, over the past calendar year.

When your organization employs cloud-based Workday Payroll Management, you will get automatic tax updates from the US government flowing straight into your module to ensure that every cent is accounted for. This helps ensure payroll and HR compliance are being met and there are no ugly surprises for anyone come April 15th.

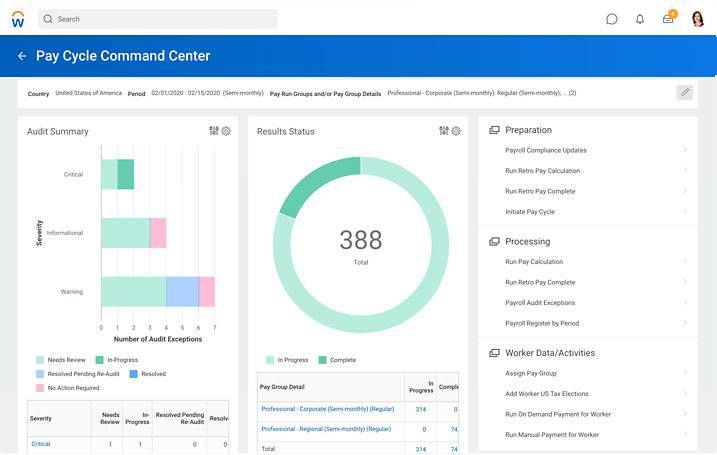

Automatic Payroll Audits

There’s nothing worse than coming into the office on Monday morning to a stack of voicemails from employees who have been paid the wrong amount. It’s a headache that Workday Payroll can make disappear, completely streamlining your payroll process in the meantime. Automatic payroll audits happen before you run your pay groups, allowing both the system’s AI components and your own staff members to evaluate what is going to be paid out and ensure it’s what is intended.

Manage Payroll Issues with Workday and ERPA

Workday Payroll takes complex problems and offers simple, reliable solutions. If you’re not getting the maximum effort from your current implementation of Workday or feel that it could be doing more, reach out to ERPA today for a free consultation from our Workday Payroll Management experts.