Empower Your Accounting Team with Workday Financial Management

By leveraging the Workday Financial Management module, you can improve financial visibility, streamline financial processes, reduce errors, and enhance financial reporting accuracy. This, in turn, can help your organization make informed decisions and more effectively achieve its strategic objectives.

This process typically involves machine learning (ML) enhanced financial procedures that identify issues and inefficiencies, continuous auditing, and augmented analytics that provide insights into your employees’ performance.

The decision to deploy Workday financial management software can feel overwhelming initially. If you are at the point of evaluating competing software to replace your current system, you likely have a mental image of the ultimate outcome you desire so your implementation choices will set the stage for all future decisions.

The implementation is but one part of the equation, however; most companies trust certified Workday post-production partners like ERPA to ensure ongoing optimization and maximization of their Workday Financial Management tenants.

Workday Financial Management: Key Features and Benefits

Here is a breakdown of some key features of the Workday Financial Management applications:

Finance Process Management

Accounting and Finance

A one-stop system for finance and accounting, utilizing embedded machine learning (ML) to increase accounting processes, detect irregularities, and provide recommendations.

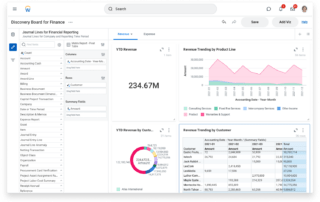

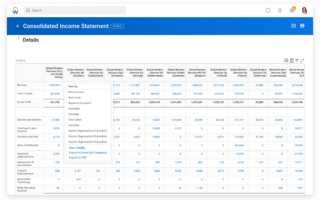

Accounting Center

Workday Accounting Center takes large volumes of transactional data from previously disparate systems and transforms it into accounting transactions, allowing you to drill down and analyze the transactional data directly from financial statements and other financial reports.

Close and Consolidate

Allows you to automate reconciliation, consolidation, reporting, closing processes, and consolidating the results from multiple companies and financial systems.

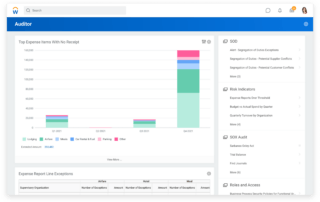

Workday Expenses

Provides user-friendly, enterprise-grade functionality that allows you to customize the way your team submits and approves expense reports.

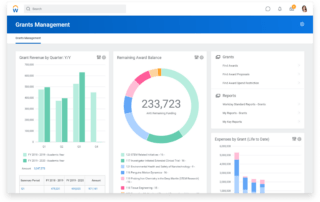

Workday Grants Management and Tracking

Eliminates reporting errors, losses from leftover funds, and risks of noncompliance.

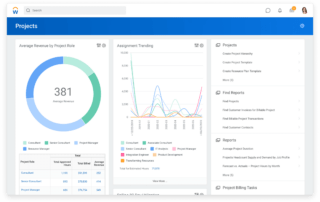

Workday Projects

Allows you to sync data across departments for effective project management, from tracking time and expenses to accurately invoicing customers.

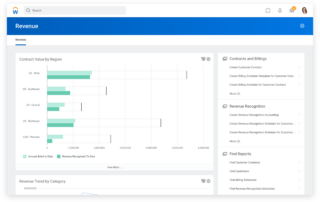

Workday Revenue Management

Flexible and scalable while still complying with GAAP and IFRS guidelines. It adapts to fluid business requirements and gives you the tools you need to reach your financial goals.

Business Strategy and Growth

Workday Adaptive Financial Planning

Works with any ERP/GL to automate and streamline finance processes.

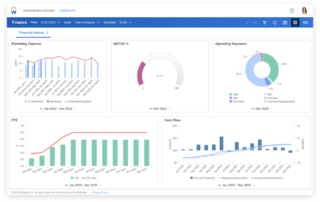

Workday Analytics and Reporting

Houses financial, workforce, and operational data all in one place, allowing for easy analysis and distribution of financial reports.

Risk Management

Audit and Internal Controls

Detects and sends alerts about workflow errors, intervening before a small mistake becomes a catastrophe.

Global Foundation

Provides accurate and auditable information, standardized processes, and provides global visibility to help you meet international requirements.

Workday Financial Management features across accounting, procurement, expense management, and more can help businesses get the most value from their investment. If you are a full suite customer (meaning have deployed Workday HCM as well as Workday Financials) then you are positioned to enjoy the Power of One across your organization.

3 Ways to Maximize Returns on Your Workday Financial Software Investment

It is not enough to apply Workday improvements on a whim; users should take a methodical approach to financial goal-setting to support growth and maximize the value of Workday Financial Management. This applies to all aspects of the system, including any goals that have been considered for financial services.

Not sure how to create a structured goal-setting approach that helps your company get the most out of its Workday investment? Read on to learn about the features and benefits included with Workday Financial Management and how your business can assess its Workday implementation.

1. Set Workday Financial Management Goals

Setting financial management goals in Workday is critical if you want to maximize the platform’s value for your organization.

To begin, define your financial management goals by asking two important questions: What do you hope to achieve with Workday? Which specific processes have given you trouble so far?

Next, work with your accounting teams to identify known issues as the first step. Finding these issues will accomplish the following:

- Improve financial report accuracy;

- Reduce the time it takes to complete financial tasks;

- Improve financial data visibility;

- Increase cost control;

- Reduce external audit requests;

- And more.

Establishing your Workday Financial Management goals sets the stage for all that is to come so don’t feel compelled to rush. Take a considerate approach to system operations and ask yourself: In a perfect world, which features and functions would be available?

You might be surprised at what Workday can do with the right configuration. Many tools are available on Workday, but some users are unaware of all that is available to them. So, take a broad approach to goal setting and keep an open mind.

Review your goals and determine which metrics to track. Financial management lives and dies by data, and key performance indicators (KPIs) are the best way to track progress toward achieving your goals.

For Workday Financial Management, these metrics may relate to:

- Accounts receivable and collections;

- Accounts payable and payments;

- Cash flow and management;

- Time to close;

- Contract management;

- Auditing and analysis;

- And more.

Lastly, benchmark your chosen metrics over time and use them as your guiding star for improvement efforts. If you are working with a post-production partner like ERPA to streamline your Workday ecosystem, this step should be easy to accomplish.

2. Assess Your Workday Financial Process and Identify Features

With some goals and tracking metrics established, the next step is to assess your current financial management processes to identify any inefficiencies, bottlenecks, or areas for improvement. This assessment can help you identify areas where Workday can be used to streamline financial management processes.

An important point to consider here is the aspirational vision you laid out for Workday in your planning stages. More likely than not, your Workday tenants can do much more than you expect, provided you know how to identify and implement core improvements.

3. Approve and Deploy Your Workday Action Plan

Finally, to maximize the value of Workday Financial Management, you must develop an action plan that specifies the tasks, timelines, and responsible parties for each financial improvement. With Workday Financial Management, companies can improve financial visibility, streamline financial processes, reduce errors, enhance financial reporting accuracy, and more.

You should align your plan with the overall objectives and priorities you outlined in your initial planning stages and monitor your progress. Take advantage of Workday’s fantastic financial management tools to guide your long-term goal-setting efforts, so that your organization can stay on top of its finances and gain the information your accounting team needs to make better decisions.

Accounting and Finance Teams Trust ERPA + Workday Financial Management

With Workday Financial Management’s innovative features, your company can manage its long-term growth. Our Workday experts at ERPA have years of experience optimizing Workday and will put it to work for your financial service departments.

If your organization is struggling with setting concrete financial management goals, or if you want to maximize returns on your Workday Financial Management investment, contact ERPA.